Bitcoin Technical Analysis for Beginners

A decent specialized analyst of a stock or a commodity can rake in boatloads of cash for himself, however a decent specialized analyst of a cryptocurrency can shoot to fame and fortune in a very short time.

Bitcoin is one such notable digital currency. To invest in it, you need to understand the technical analysis behind Bitcoin. All things considered, without technical analysis, trading cryptocurrencies becomes a dangerous speculating game!

This article is a little technical, but it is intended to assist beginners to understand the fundamentals of Bitcoin and how technical analysis can help them make sensible investment decisions. If you want to be a successful investor in digital currencies, then this blog is an extraordinary beginning stage.

Why Should Beginners Begin with Bitcoin?

If you are new to the world of blockchain and digital currency, it can get overpowering to sift throughreliable cryptocurrencies from questionable ones.

Several cryptocurrencies, prominently named as “meme coins”, like Dogecoin, Shiba Inu and Poocoin have popped up in recent times and have cost mature investors anenormous lump of their investments.

Then again, Bitcoin is a lot more secure (if not the most secure) cryptocurrency to invest in. It is the first deflationary crypto to appear and has as of late arrived at a record-breaking highof over USD 65,000 for every Bitcoin! Here are a few additional motivations to trust Bitcoin:

1. Most decentralised cryptocurrency

2. Publically accessible whitepaper

3. Deflationary currency

4. Crystal clear tokenomics

5. Proof of Work (POW) component

Technical Analysis: An Overview

On the more extensivespectrum of things, there are two sorts of Bitcoin investors:

1. HODLers – Individuals who purchase Bitcoin with no aim to sell for a long time.

2. Traders – Individuals who purchase Bitcoin planning to sell it rapidly at a profit. If you want to grow your money faster than traditional methods by investing in Bitcoin, sharpening your technical analysis skills is most crucial.

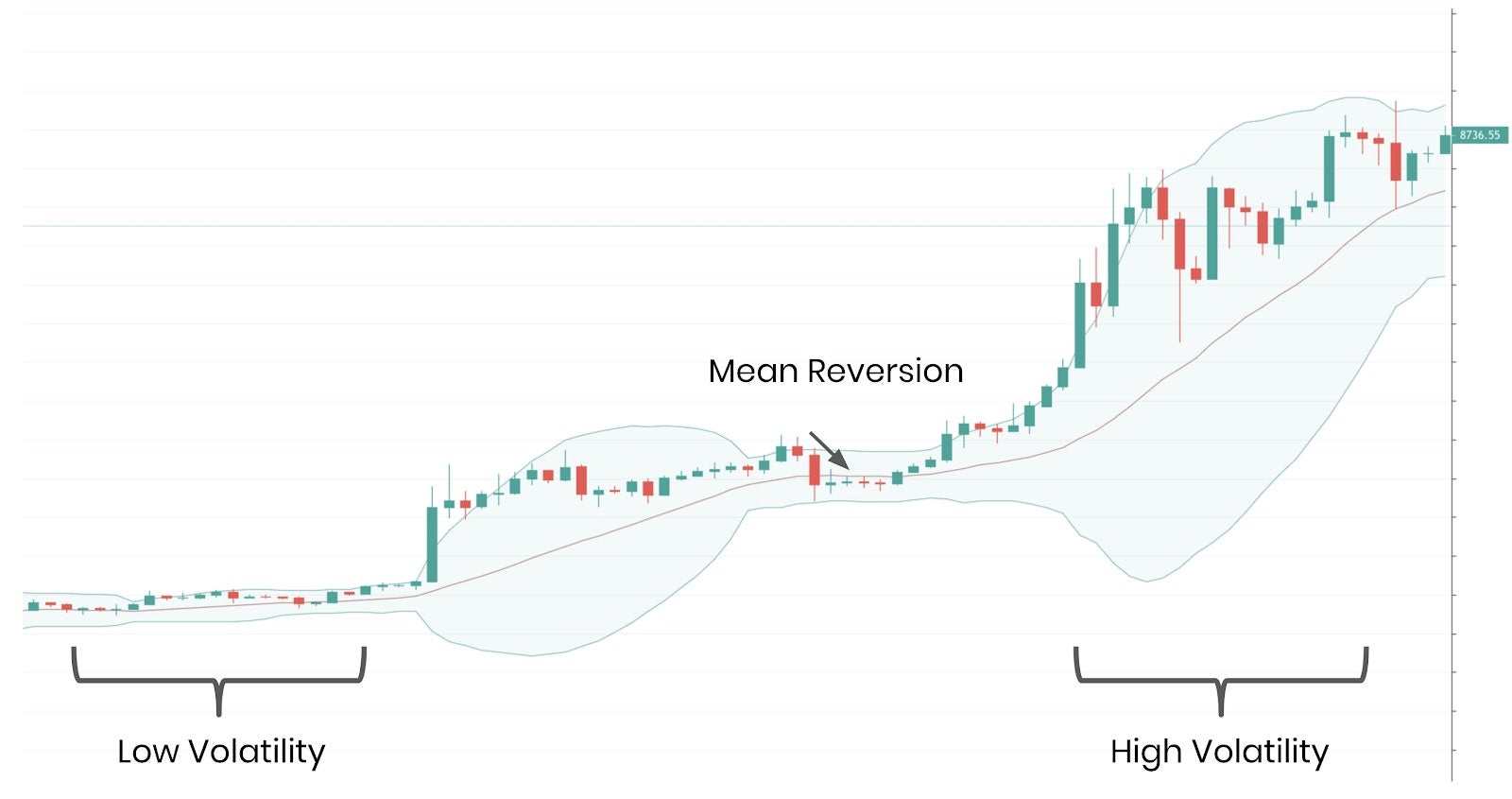

Technical analysis uses the idea of price patterns from the past and technical indicators to analyse the outlines and foresee the future developments inprice. This can be applied to any market, including digital currencies such as Bitcoin (BTC).

When done right, technical analysis helps you precisely anticipating the lows and highs of Bitcoin prices throughout various time-frames. Such forecasts will help you make educated and data-driven decisions on buying Bitcoin at a good price and selling it at a profit.

Getting Started with Bitcoin Technical Analysis Indicators

To get everything rolling with technical analysis, you would want a platform that provides reliable and advanced tools for the same. Coinbaazar ,a Georgian based cryptocurrency exchange, provides all the necessary tools and more for a beginner to get started with Bitcoin technical analysis.

Here are two indicators to get started with for beginners:

1. Moving Average Weighted (MAW)

MAW is used to gauge the overall market sentiment. This is done by analyzing the price fluctuations in the occurrence of the short, mid and long-term moving averages. The moving average is calculated by simply taking the average of the data points in a given period of time.

Upon perception, you can conclude that when the MAW line (blue line) is over the bars, it shows a descending pattern. Additionally, when the MAW line is under, it indicates an ascending pattern trend.

Note: that MAW ought to be ideally used to analysis price movements over a shorter period (days or hours) and not over long periods like months or years.

2. Relative Strength Index (RSI)

RSI is a ‘momentum indicator’. It works by comparing the magnitude of the recent growth to recent downturns to measure the speed and change of price movements. It sways between 1 and 100. It is anoverall belief that RSI should be under 30 for buying and over 70 for selling.

As you can see from the example, Bitcoin exhibited an upward trend every time the RSI reached a major low and exhibited a downward trend when RSI peaked.

In simpler words, the lower the RSI, the more undervalued is the asset.

3. Williams Fractal

This is a momentum indicator, and it is based on the ADX formula. While ADX can assist you dive into the micro, Williams Fractal is a great indicator for a quick macroscopic view of the momentum trends.

This wavering indicator shows the strength of both the vertical and descending development in the price of an asset.

The downside to this indicator is that it often produces several false positives. Hence, using other indicators like ADX and RSI in conjunction with Williams Fractal is advisable to make better trading decisions.

Fundamental Analysis vs. Technical Analysis

Fundamental analysis is based on the idea that the price of an asset is determined by underlying factors such as the company’s performance, management and market size.

Then again,technical analysis does not consider any economic or fundamental factors. It is purely focused on the chart and the indicators like RSI, MACD and candlestick patterns.

Conclusion

To conclude, Bitcoin trading is definitely athrilling market, one that many people want to get involved in. However, it is it is essential to comprehend the digital currency market before you start trading.

If you are keen in getting started with Bitcoin trading and understanding the intricacies of technical analysis, get on board coinbaazar and start Buying, selling or investing with as little as $5