Price Analysis of Bitcoin & some of the most Active Altcoin’s

BTC and altcoins streaked a couple of bullish signs on Feb. 23, yet traders say $38,000 is as yet the level Bitcoin needs to close above before an inversion can start.

Analysis of price: BTC, ETH, BNB, XRP, ADA, SOL, AVAX, LUNA, DOGE, DOTPRICE Review

Bitcoin (BTC) and a few altcoins have skipped off their nearby support levels after buyer sendeavoured to capture the current decrease. Bloomberg senior commodity strategist Mike McGlone featured in a new tweet that Bitcoin was trading generally 20% beneath its 50-week moving average and such limited levels have “regularly brought about great price support.”

The negative price activity of the beyond couple of days doesn’t appear to have prevented the institutional traders from amassing at lower levels. As indicated by CoinShares’ Feb. 22 “Digital asset Streams Week by week” reports, institutional investors siphoned about $90 million into Bitcoin assets between the second and third week of February. 18. Taking the absolute inflows in the current month to $178 million.

Crypto traders don’t appear to be excessively apprehensive by the current half rectification. In a survey directed by Deutsche Bank, just around 35% of the respondents said they would decrease their trading a very negative crypto economic situation. A greater part, over 75%, said they wanted to build their crypto action over the course of the following a half year.

Could Bitcoin and altcoins support the help rally or will bears jump and slow down the recuperation? We should analyse the charts of the top-10 cryptocurrency to find out.

BTC/USDT

Bitcoin skipped from the principal support at $36k and the bulls will presently endeavour to push the price over the upward resistance zone among $40k and the 50-day SMA ($41k).

Assuming they figure out how to do that, the BTC/USDT pair could ascend to $46k where the bears are probably going to mount a solid resistant.

The long wick on Feb. 23’s candle proposes that bears are endeavouring to flip $40k into resistance. The down sloping moving averages and the general strength index in the negative domain propose that bears have the high ground.

A break and close beneath $36k will flag the resumption of the down move. The pair could then decrease to $34k and later retest the Jan. 24 low at $32,917.

ETH/USDT

Ether (ETH) skipped off the psychological support at $2,500 on Feb. 22. The bulls have pushed the price over the breakdown level of $2,650, showing solid buying at lower levels.

The buyers will presently attempt to impel the price over the moving averages. Assuming that they succeed, the ETH/USDT pair could energize to the resistance line of the even triangle pattern. The bulls should push the price over the triangle to flag the beginning of a new upturn.

Then again, assuming the price diverts down from the moving averages, the bears will attempt to pull the pair underneath the help line of the triangle. Assuming they figure out how to do that, it will propose that the even triangle has gone about as a continuation pattern. The pair could then drop to $2,100 and later to $2,000.

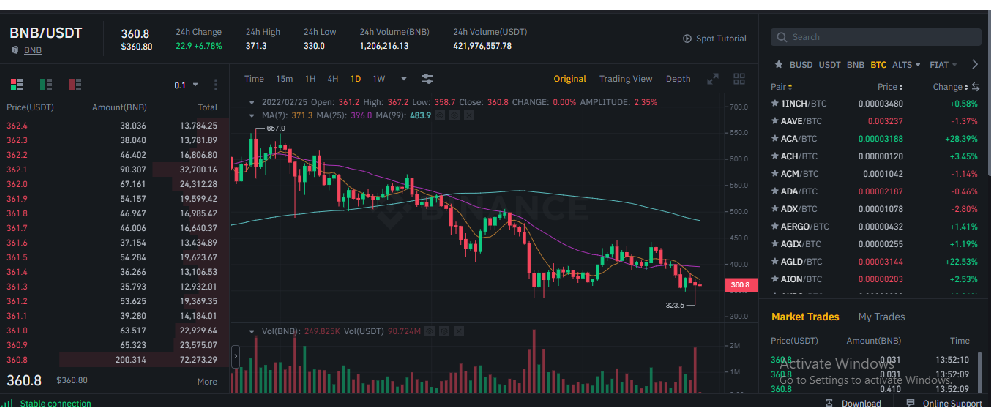

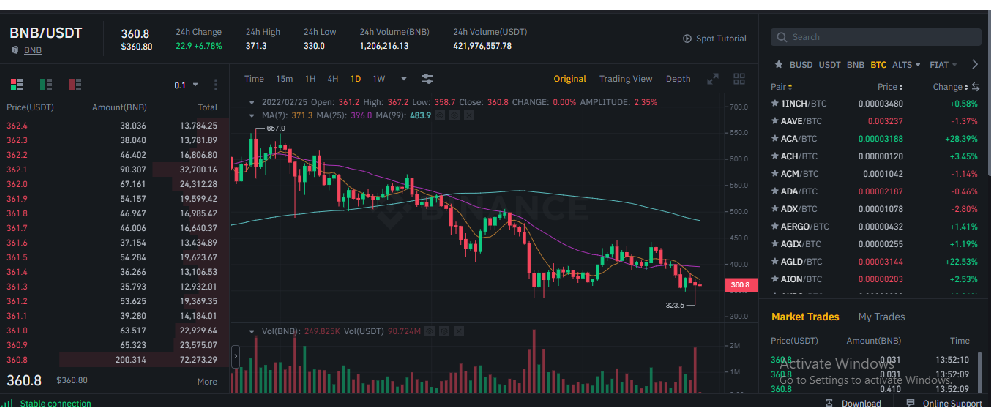

BNB/USDT

BNB skipped off the solid support at $350 on Feb. 22 demonstrating that bulls are not down and they keep on buy at lower levels. The bulls will currently endeavour to drive the price over the downtrend line of the plunging channel.

Assuming they figure out how to do that, the BNB/USDT pair could ascend to the 50-day SMA ($416). This is a significant level for the bears to safeguard on the grounds that a break above it could flag a potential change in pattern. The pair could from that point ascend to $445.

Alternately, in the event that the price diverts down from the downtrend line, the bears will fancy their possibilities and make another endeavour to pull the pair beneath $350. Assuming that occurs, the pair could drop to the solid support zone at $320 to $330.

XRP/USDT

Swell (XRP) skipped off $0.66 on Feb. 2 and the bulls pushed the price over the 50-day SMA ($0.72). The buyers will presently endeavour to clear the upward obstacle at $0.75.

Assuming they figure out how to do that, the XRP/USDT pair could ascend to the downtrend line. The bulls should push the pair over this line to demonstrate that bulls are back in the game. The pair could then energize to $0.91.

On the other hand, assuming the price diverts down from $0.75, it will recommend that bears have flipped the level into obstruction. The bears will then, at that point, endeavour to pull the price underneath $0.66 and stretch out the decrease to $0.60.

ADA/USDT

Cardano (ADA) has skipped off the solid help close $0.80, showing that buyers are attempting to capture the decline. The price could now arrive at the breakdown level at $1.

Assuming buyers push and support the price above $1, it will recommend that the business sectors have dismissed the lower levels. The bulls will then, at that point, endeavour to push the price to the resistance levels of the plummeting channel. A break and close over the channel will flag a potential pattern change.

In spite of this suspicion, assuming the price diverts down from $1, it will propose that bears have flipped this level into obstruction. The sellers will then, at that point, attempt to pull the pair below $0.80 and continue the downtrend.

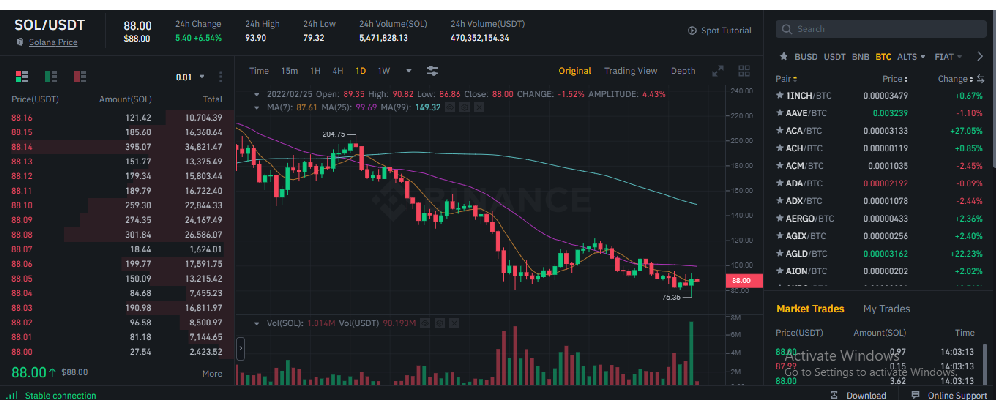

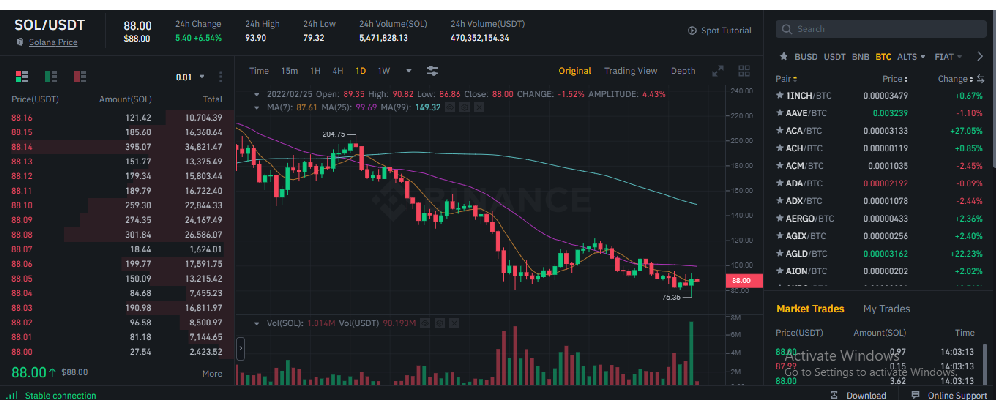

SOL/USDT

Solana (SOL) bobbed off the $81 support on Feb. 22, showing that buyers are attempting to shield this level. The RSI is giving indications of shaping a positive difference, showing that the negative energy could weaken.

In the event that buyers drive and support the price over the 20-day EMA ($97), the SOL/USDT pair could revitalize to the obstruction line of the dropping channel. This level could go about as a significant obstruction yet in the event that bulls conquer it; the pair could mobilize to $122.

A break and close over this resistancewill finish a twofold base example. This bullish setup has an objective goal at $163. This positive view will negate assuming the price diverts down from the 20-day EMA or the obstruction line and plunges beneath $81. That could open the entryways for a further decay to $66.

AVAX/USDT

Torrential slide (AVAX) broke below the moving averages on Feb. 20 yet the bears couldn’t expand upon this benefit. Solid buy close $67 has brought about a bounce back and the price has arrived at the moving averages.

In the event that buyers push and support the price over the moving averages, the AVAX/USDT pair could energize to the downtrend line. The bears are probably going to protect this level aggressively.

Assuming the price diverts down from the downtrend line yet skips off the moving averages, it will demonstrate that traders are buy on plunges. That will work on the possibilities of a break over the channel. On the off chance that that occurs, the pair could initially ascend to $100 and rally toward $117.

Then again, assuming that the price diverts down from the current level, the bears will endeavour to pull the pair underneath $67 and continue the downtrend.

Related: Even in a rough crypto market, this algorithmic pointer assisted traders with distinguishing the couple of champs

LUNA/USDT

LUNA token broke and close over the 20-day EMA ($54) on Feb. 22, which was the primary sign that the venders might be losing their grasp. Supported buy has pushed the price to the downtrend line of the plummeting channel.

The 20-day EMA has straightened out and the RSI has bounced into the positive domain, recommending a minor benefit to buyers. A break and close over the 50-day SMA ($62) will show a potential pattern change. The LUNA/USDT pair could then energize to $70 where it might again confront resistance from the bears.

As opposed to this presumption, assuming the price diverts down from the 50-day SMA, it will flag that bears are endeavouring to shield the upward resistance. Assuming the price bounce back off the 20-day EMA, it will demonstrate that bulls are buying the plunges. That will expand the chance of a break over the 50-day SMA. This positive view will be discredited assuming bears pull the price beneath the 20-day EMA.

DOGE/USDT

Dogecoin (DOGE) bounced back off the solid support at $0.12 on Feb. 12, recommending that the bulls have not yet surrendered and are buying on plunges.

The alleviation rally is probably going to confront solid resistance at the moving averages yet the positive uniqueness on the RSI favours the buyers. Assuming that the bulls push and support the price over the 50-day SMA ($0.14), the DOGE/USDT pair could ascend to $0.17.

A break and close over this level will finish a twofold base example, which has an objective goal at $0.22. On the other hand, on the off chance that the price diverts down from the moving averages, the bears will fancy their possibilities and attempt to sink the pair underneath $0.12. Assuming they succeed, the pair could drop to $0.10.

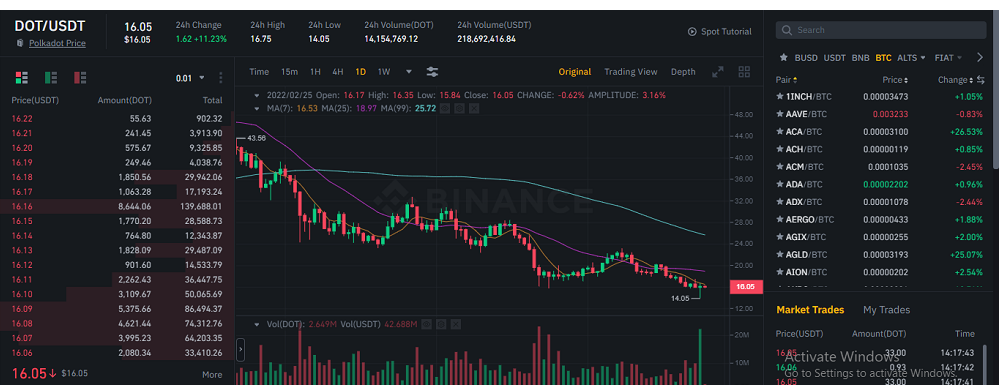

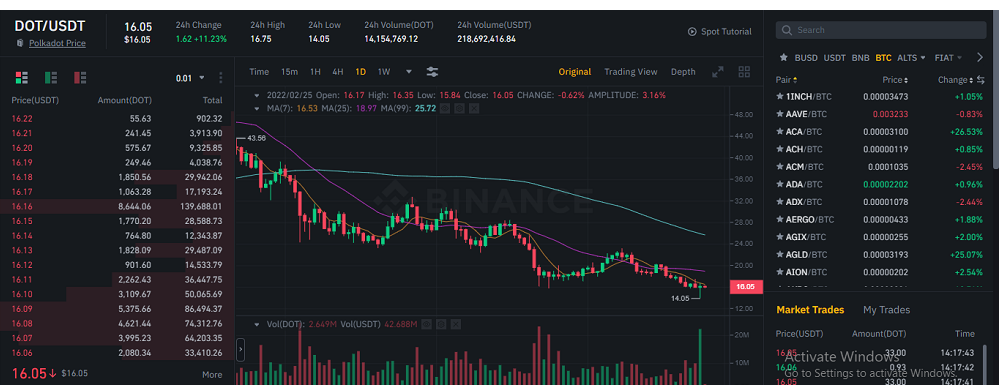

Dot/USDT

Polkadot (DOT) has skipped off the support at $15.80, demonstrating that the bulls have not given up and they keep on buy at lower levels. The RSI is giving indications of shaping a positive difference, proposing that the selling movement could debilitate.

The DOT/USDT pair could now ascend to the downtrend line, which is probably going to go about as a solid resistance. Assuming the price diverts down from this level, the bears will again attempt to pull the pair underneath $15.80 and continue the downtrend.

Alternately, assuming bulls drive the price over the downtrend line and the 50-day SMA ($21.14), the pair could ascend to the upward resistance at $23.19. A break and close over this level will finish a twofold base example.

The views and opinions expressedhere are exclusively those of the creator and don’t really mirror the perspectives on Coinbaazar. Each speculation and trading move implies certain risks. You should direct your own study while making a choice.

Market information is given by HitBTC trade.

#Bitcoin

#Dogecoin

#Cryptographic forms of money

#Altcoin

#Ethereum

#Bitcoin Price

#XRP

#Markets

#Cardano

#Price Investigation

#Binance Coin

#Polkadot

#Ether Price

#Solana

#Torrential slide

#Land